tax deferred exchange definition

Everything that would normally be taxable is still taxable under a tax-deferred exchange. Subject to accrued liabilities of the business in exchange solely for common shares of Newco.

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

The Definition of Like-Kind Properties Has Changed Over the Years.

. The property must be held for investment though not resale or personal use. Over the long term consistent and proper use of this strategy can pay. To receive the full benefit of a 1031 exchange your replacement property should be of equal or greater value.

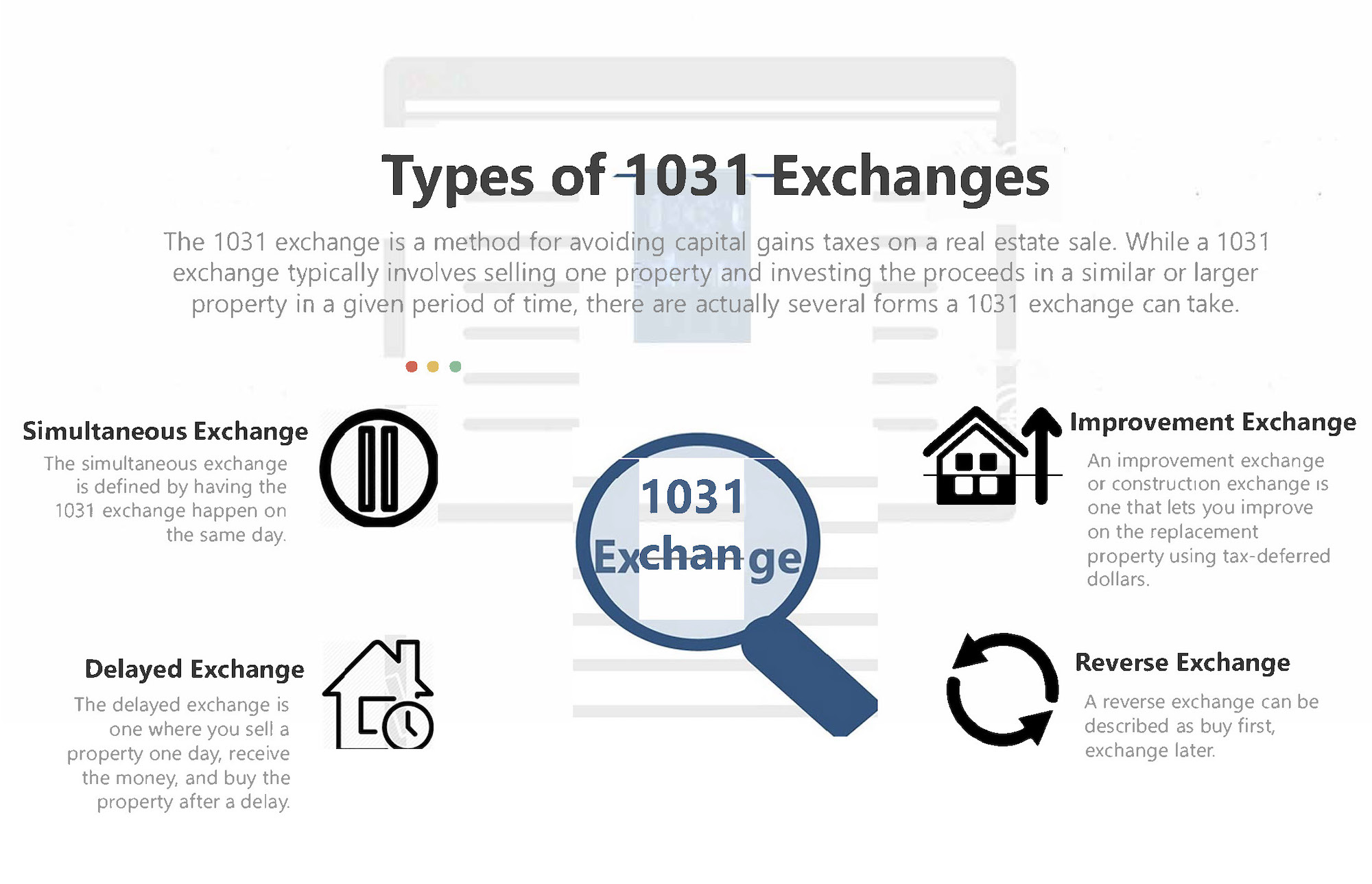

If on the other hand Newco also assumes a bank loan in excess of the basis of the assets transferred less the accrued liabilities John and Mary will recognize taxable. A 1031 exchange otherwise known as a tax deferred exchange is a simple strategy and method for selling one property thats qualified and then proceeding with an acquisition of another property also qualified within a specific time frame. A third party is an individual or entity that is involved in a transaction but is not one of the principals and has a lesser interest.

You must identify a. The logistics and process of selling a property and then buying another property are practically identical to any standardized sale and. The only difference is that the taxes wont be paid in the year of the sale.

Ultimately the 1031 exchange is a completely legal tax-deferred strategy that any taxpayer in the United States can use. But you cant exchange real estate for artwork for example since that does not meet the definition of like-kind. A corporate tax also called.

This usually implies a minimum of two years ownership. The 1031 tax-deferred exchange strategy only defers taxesit doesnt help you dodge them altogether. Under United States principles this transfer does not cause tax to John Mary or Newco.

1031 Exchange Rules How To Do A 1031 Exchange In 2021 Jones Hollow Realty Group

Are You Eligible For A 1031 Exchange

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

What Is A 1031 Exchange Asset Preservation Inc

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

1031 Exchange When Selling A Business